The FMCSA uses 7 driving improvement categories to determine a carrier's safety performance relative to other carriers. The Behavior Analysis and Safety Improvement Categories or (BASICs) are used to determine a carriers CSA score and to measure how safely the carrier operates.

Mike Riegel

Recent Posts

What are the 7 FMCSA BASICs used to calculate CSA scores?

Oct 21, 2022 10:13:26 AM / by Mike Riegel posted in Safety, FMCSA, DataQ

Blue Ink Tech becomes a truck scale supplier on weighingreview.com

Oct 20, 2022 12:33:28 PM / by Mike Riegel

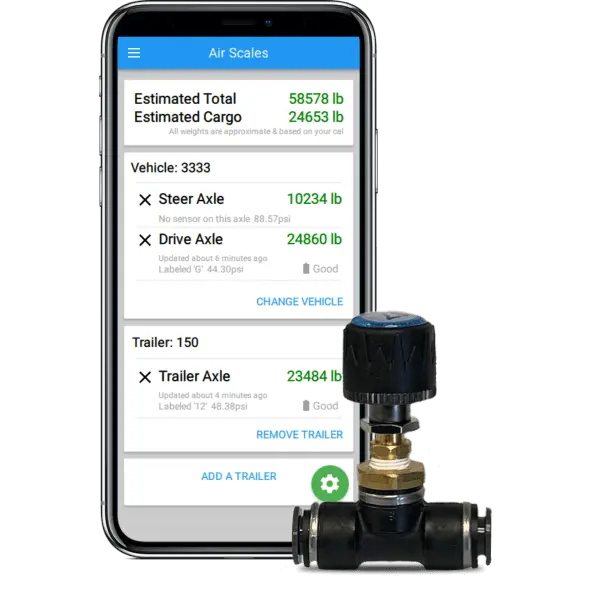

Blue Ink Tech has just been listed as a supplier on weighingreview.com for is onboard truck scale bluetooth sensors.

What to look for before buying an onboard truck scale system

Oct 20, 2022 8:13:35 AM / by Mike Riegel

Scaling is one of the trucking industry's biggest pain points. Most shippers don't have their own truck commercial weight scales on site and drivers usually have to drive out of the way to find a scale to use. This can be a huge burden for the carrier and driver that costs fuel, unnecessary drive time, and overweight violations.

What are the ELD requirements?

Oct 10, 2022 10:14:46 AM / by Mike Riegel posted in ELDs, Logbook, DOT, Hours of Service

ELDs or "electronic logging devices" are devices that are required for most commercial motor vehicle drivers to keep their records of duty status (RODS) electronically for their hours-of-service (HOS) logbooks. The FMCSA published the ELD mandate back in December 2017 with strict guidelines on how electronic logging devices have operate in order to be certified for industry use. This guide will help you understand what ELD providers must do under the ELD mandate to be compliant with the FMCSA.

8 Ways to Lower your Commercial Truck Insurance Rate

Sep 28, 2022 1:58:32 PM / by Mike Riegel posted in ELDs, Insurance

Truck insurance is one of the main expenses a trucking company will have to pay. With claims that are able to easily cross over $100,000+ it takes a lot to cover a truck on the road. The FMCSR requires all carriers to have a minimum of $750,000 in liability insurance just to operate. A new owner/operator can expect to pay $1,500 - $3,500 per month using their own authority. High insurance rates is a main reason why newer owner/operators prefer to lease on to another company.